Welcome!

The ACOL Personal Property Registry System (PPRS) provides access for businesses and individuals to register and search personal property interests in the following Canadian provinces and territories:

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Prince Edward Island

- Yukon

Your menu choices:

- Introduction - Get started learning about PPRS, including with a couple of diagrams.

- How to Use PPRS, Definitions, and What PPRS is Not – Additional introductory information.

- Sign Up – Descriptions and instructions for setting up and managing an ACOL PPRS client account and its users.

- Support – Helpful information for ACOL PPRS users.

- Jurisdictions – Information about each of the participating ACOL PPRS provinces and territories.

- Contact – Toll-free telephone, email, fax, and mail information for the ACOL Client Support Centre.

From every PPRS page you can access the following:

- Lien Check – The top (green) box to the right will introduce the Lien Check Service, including providing a link to the service.

- PPRS Login (opens new tab) – The middle (blue) box to the right will take you to the PPRS Login page.

- Website Help – The bottom (orange) box to the right will take you to a website help page.

- Jurisdiction crests - Click on one of the crests at the top right of every page to go directly to that jurisdiction’s PPRS page.

The Personal Property Registry (PPR) is a computer database that records interests in personal property (motor vehicles, boats, inventory, accounts, etc.). It is used primarily by financial institutions, but it is also important for individuals and businesses who are considering buying personal property.

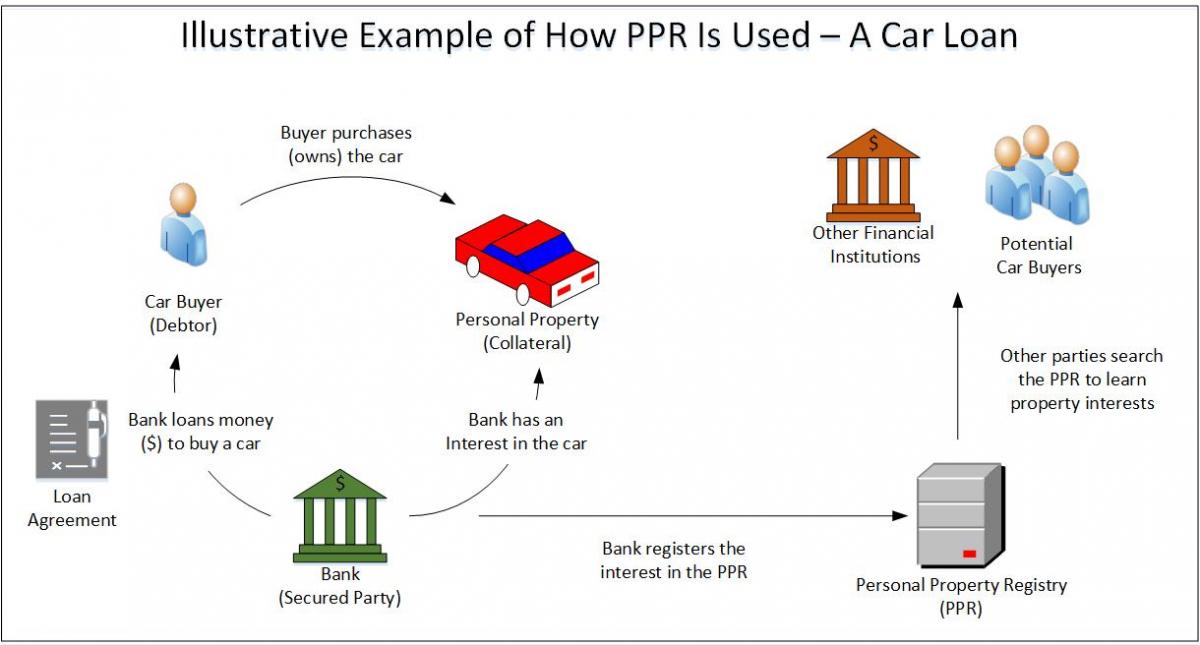

Here is an example of how the PPR is used:

- When you arrange a car loan, the car is collateral (security) for your loan. Until you have repaid the loan, the lender has an interest in the car. The lender registers that security interest in the PPR. This information is available to anyone planning to purchase the car or grant another loan using the car as collateral. (See an illustrative example below.)

The law – the Personal Property Security Act (PPSA) – provides protection for the lender’s security interest. For example, if you sold the car without paying the amount owing, the lender could seize the car from the new owner in order to pay off the outstanding debt. To avoid that situation, the new owner (buyer) should search the PPR in order to identify if there are any registered interests before buying the car.

Most PPR registrations are for consumer and business financing, like a car loan or line of credit, but not all of them. For more information, see personal property and registration types.

Click on the following image to open it in a new tab or window.

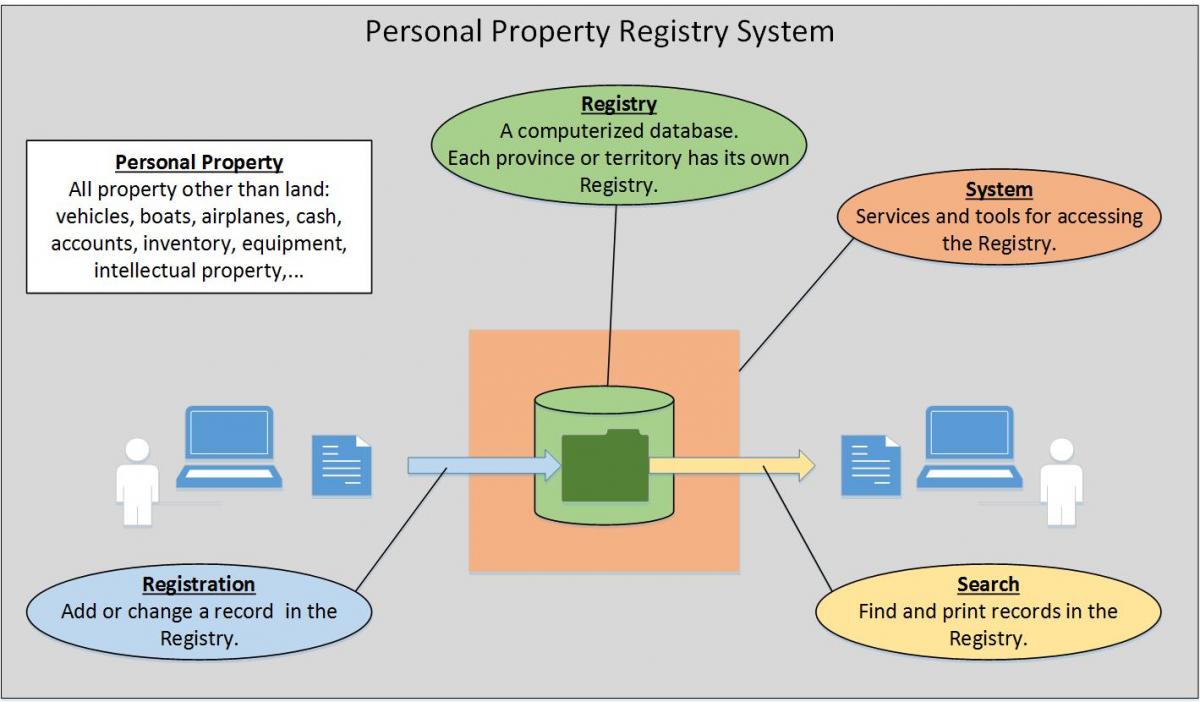

The Personal Property Registry System (PPRS) is a set of services and tools that provides access to the Personal Property Registry (PPR). PPRS has two primary functions:

- Registration - Add or change a property interest record in the Registry.

- Search - Find and print records in the Registry.

In order to support registration and search, PPRS also includes functions for secure login, administering user information, retrieving reports, and paying fees. ACOL PPRS users are supported by the ACOL Client Support Centre and the ACOL Business Financial Office.

Click on the following image to open it in a new tab or window.

Every province and territory in Canada has its own Personal Property Security Act (PPSA) and Personal Property Registry (PPR). The ACOL PPRS supports the following provinces and territories:

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Prince Edward Island

- Yukon

If you are interested in a jurisdiction not listed above, we may be able to help you find the Registry for another jurisdiction here.

ACOL PPRS provides a single user interface for all of the provinces and territories listed above. For example, an authorized user who logs into ACOL PPRS can enter one registration in New Brunswick, a second registration in Prince Edward Island, then search in Nunavut, and pay for all of the transactions via a single ACOL client account.

With the exception of the Lien Check Service, you will need an ACOL client account in order to use ACOL PPRS. There can be multiple users within your account. If you do not wish to set up an ACOL account, there are also value-added service providers who are available to perform registrations and searches for you.

ACOL stands for Atlantic Canada On-Line. ACOL is an initiative founded by the four Atlantic Provinces in order to share in creating and operating online government services. ACOL services are provided to participating provinces and territories by Unisys Canada Inc.

ACOL has been providing online government services since 1997. For more information, please see the ACOL web site (opens new tab).