Every province and territory in Canada has its own Personal Property Security Act (PPSA) and Personal Property Registry (PPR). The ACOL PPRS supports the following provinces and territories:

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Prince Edward Island

- Yukon

If you are interested in a jurisdiction not listed above, we may be able to help you find the Registry for another jurisdiction here.

PPSA is provincial and territorial law. Each province and territory has its own Act and Regulations. The Act defines applicable personal property interests and their effectiveness, relative priority, registration, enforcement, etc. The Act also mandates the electronic registry known as the Personal Property Registry (PPR). PPSA Regulations detail operations of the Registry, including instructions for registering and searching.

The links below will help you find PPSA legislation for ACOL PPRS jurisdictions:

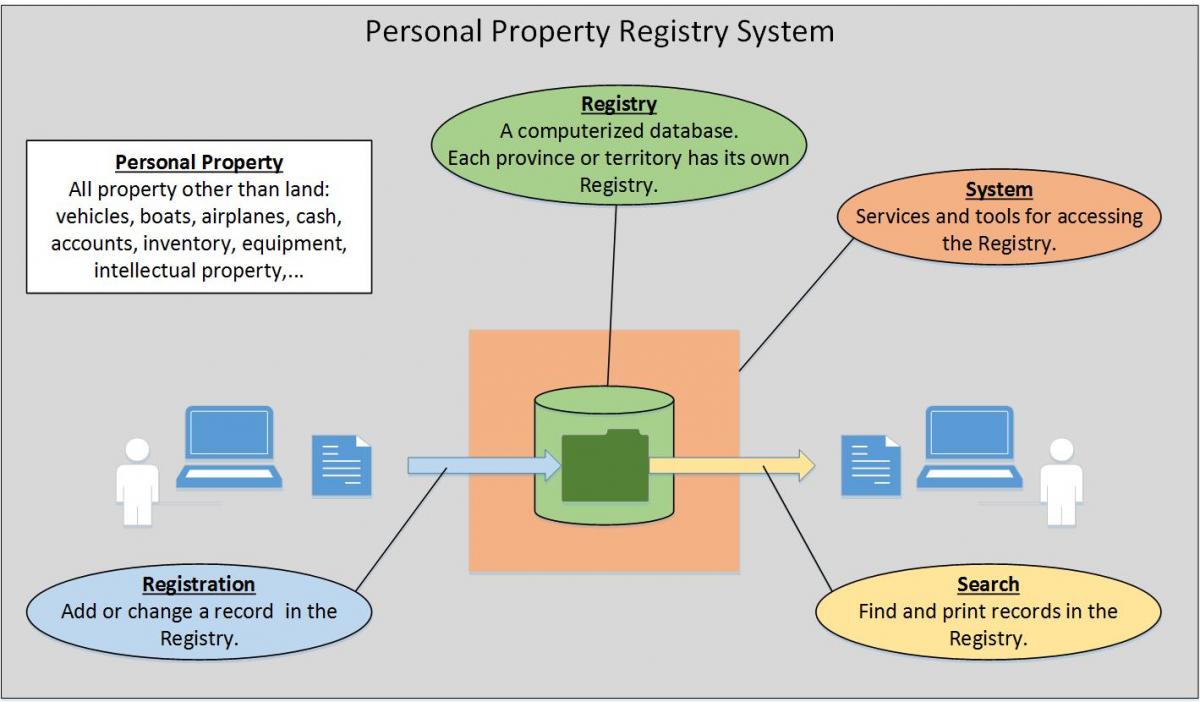

The Personal Property Registry (PPR) is a computer database that records interests in personal property (motor vehicles, boats, inventory, accounts, etc.). It is used primarily by financial institutions, but it is also an important tool for individuals and businesses who are considering buying personal property.

The Personal Property Registry System (PPRS) is a set of services and tools that provides access to the Personal Property Registry (PPR). PPRS has two primary functions:

- Registration - Add or change a property interest record in the Registry.

- Search - Find and print records in the Registry.

In order to support registration and search, PPRS also includes functions for secure login, administering user information, retrieving reports, and paying fees. ACOL PPRS users are supported by the ACOL Client Support Centre and the ACOL Business Financial Office.

Click on the following image to open it in a new tab or window.

Most PPRS functions are accessible to authorized users only. The Lien Check Service is an exception. Lien Check provides access for anyone to perform a search for serial numbered goods -- a car, trailer, mobile home, airplane, boat or outboard motor -- by paying with a credit card.

PPRS registration, search and administrative functions are summarized below.

If you are a PPRS user the following functions may or may not appear in your application menu depending upon your access privileges.

Registration functions (adding a record to the PPR):

- Enter a Registration: create a new, original registration.

- Renew: extend the term of an existing registration (changes the Expiry Date).

- Amendment: change an existing registration's details (all editable values other than the Expiry Date).

- Discharge: mark a registration as no longer active (total discharge).

- Re-registration: re-activate a registration that has been discharged or lapsed for less than 30 days.

- Global Change of Registered Interest: update or replace the secured party information for all registrations containing the designated Secured Party Number.

Search functions (querying the PPR in order to identify and read records):

- Search by Serial Number (for serial numbered collateral).

- Search by Individual Debtor Name (for a person).

- Search by Enterprise Debtor Name (for a corporation, business, company, association, trust, etc.).

- Search by Registration Number (for an existing registration).

Administrative and support functions (functions to help users perform registrations, access their reports and manage their client accounts and users):

- ACOL PPRS Batch Mode: perform multiple registrations and searches via a high-volume interface.

- Create, Update, or View Secured Party Number (records used to help enter registrations).

- Create, Update, or View PPR Client Information (records used to identify the person who performed a registration).

- Retrieve Reports: a list of PPRS reports which may be viewed, saved (downloaded) or printed.

- ACOL Client Services: a set of functions for managing client accounts and users.

For a more detailed description of ACOL PPRS functions see the online help pages as follows:

- PPRS Functions (opens in a new tab)

- ACOL Client Services (opens in a new tab)

- Retrieve Reports (opens in a new tab)

Generally speaking, personal property includes all property that is not land (or permanently affixed to land). For example, personal property includes the following:

- Movable goods like motor vehicles, equipment, tools, appliances, furnishings and jewelry

- Various forms of money, investments, receivables and proceeds

- Temporary rights in land and goods such as leases

- Land-related goods like crops, minerals, and fixtures

- Intangibles such as intellectual property

In PPSA and PPRS, personal property is typically collateral that is the subject of a security interest. For example, the car that is collateral to secure a car loan. Because the car has been offered as collateral, we call the loan "secured". If there were no collateral, we would refer to the loan as "unsecured"

As a primary subject within PPRS, "personal property" is explicitly defined within each jurisdiction’s Personal Property Security Act (PPSA). The Act’s terms and definitions cover not only the various categories of personal property, but also changes affecting personal property such as movement between jurisdictions, changes in ownership, and proceeds from sales. To fully understand personal property in PPRS, consult your PPSA.

When personal property, such as a car, is offered as collateral in a loan, we say that the loan is "secured" by the car. In this example, the lender has a "security interest" in the car. The lender does not own the car, but if the loan obligation is not paid, the lender has rights in the car as defined in the loan agreement and as governed by the Personal Property Security Act (PPSA).

There are many types and forms of security interests in PPSA and in the Personal Property Registry System (PPRS). Most PPR registrations are for consumer financing, like a car loan, but certainly not all of them. Business financing is extremely important. For example:

- A company borrows to purchase equipment with the equipment as collateral.

- A company establishes a line of credit with the company’s accounts receivable as collateral.

- A farmer finances seeds and fertilizer with the resulting crop as collateral.

- A movie producer finances a new film with the licensing rights to the film as collateral.

PPRS registration types are one of the ways to distinguish between groups of security interests. The registration type is a classification selected by the person entering the registration. The registration details vary by registration type, for example: some registration types do not require entry of court information, but some do.

The most common registration type in PPRS is the PPSA Financing Statement. This is the registration type that would be used for the consumer and business financing examples described under "Security Interests". The PPSA Financing Statement is also the only registration type that occurs in all six ACOL PPRS jurisdictions. Other registration types vary according to the jurisdiction’s PPSA Regulations. Within PPRS, you can see the list of registration types for each jurisdiction on the first page of the Enter a Registration function.

Here are some possible PPR registrations that are examples of security interests not related directly to financing. These may or may not apply within a jurisdiction depending upon its PPSA and the supported registration types.

- An individual or company receives a court judgment awarding payment of money. The court judgment will typically define a specific amount to be paid, but the security interest may be defined very generally, for example: "all present and after-acquired personal property"

- A court orders one party to pay money to another party.

- A statute (law) establishes that if an obligation is not fulfilled, one party may take a security interest in the property of another party.

To see a full list of registration types for each ACOL PPRS jurisdiction, see the Registration Types page in PPRS online help (opens in new tab).